Medicare Supplement Plans

A Medicare Supplement Plan can lower your out-of-pocket health care costs dramatically. These plans fill the gaps that are left behind in Medicare by paying your out-of-pocket costs for you. To learn more about what a Medicare Supplement Plan can offer you, keep reading.

Reach out to us today to book an appointment with one of our experienced agents!

What is a Medicare Supplement Plan?

Medicare Supplement Plans, or Medigap Plans, are insurance plans that provide supplemental coverage to Medicare beneficiaries. To enroll in these plans, you must be enrolled in Part A and Part B of Original Medicare. Unlike Original Medicare, Medigap plans are not administered by the government. Instead, private insurance companies contract with Medicare to sell these plans.

The plans are very standardized, meaning you will get the same benefits as other people who are enrolled in the same plan across the country.

Medigap Benefits

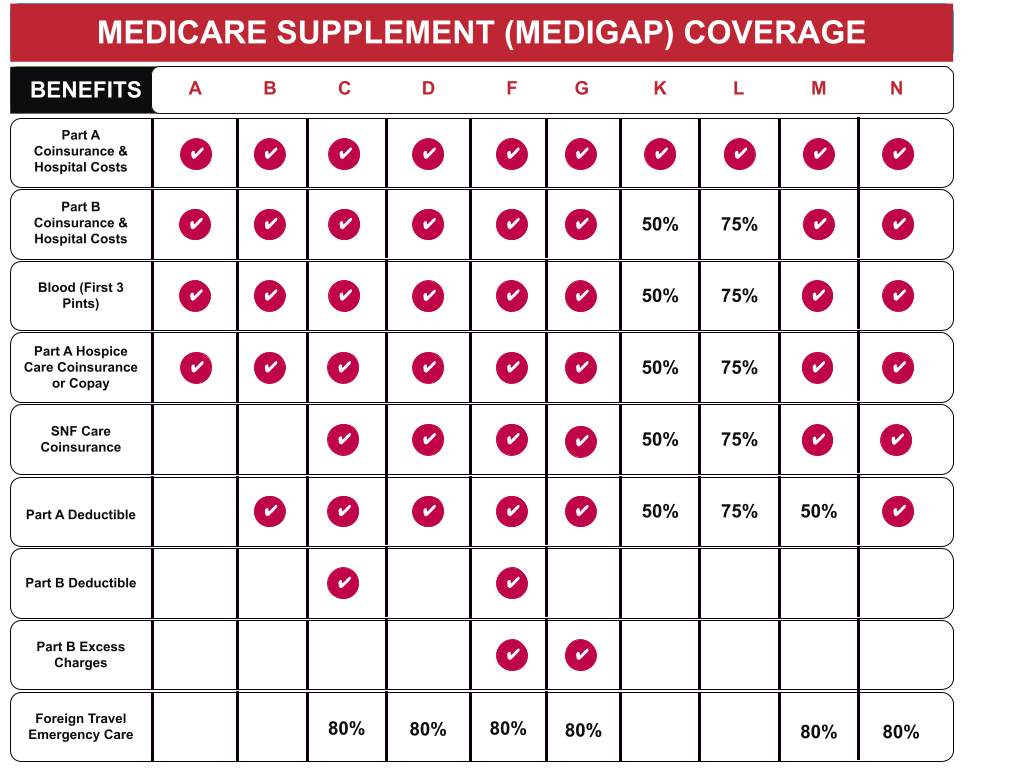

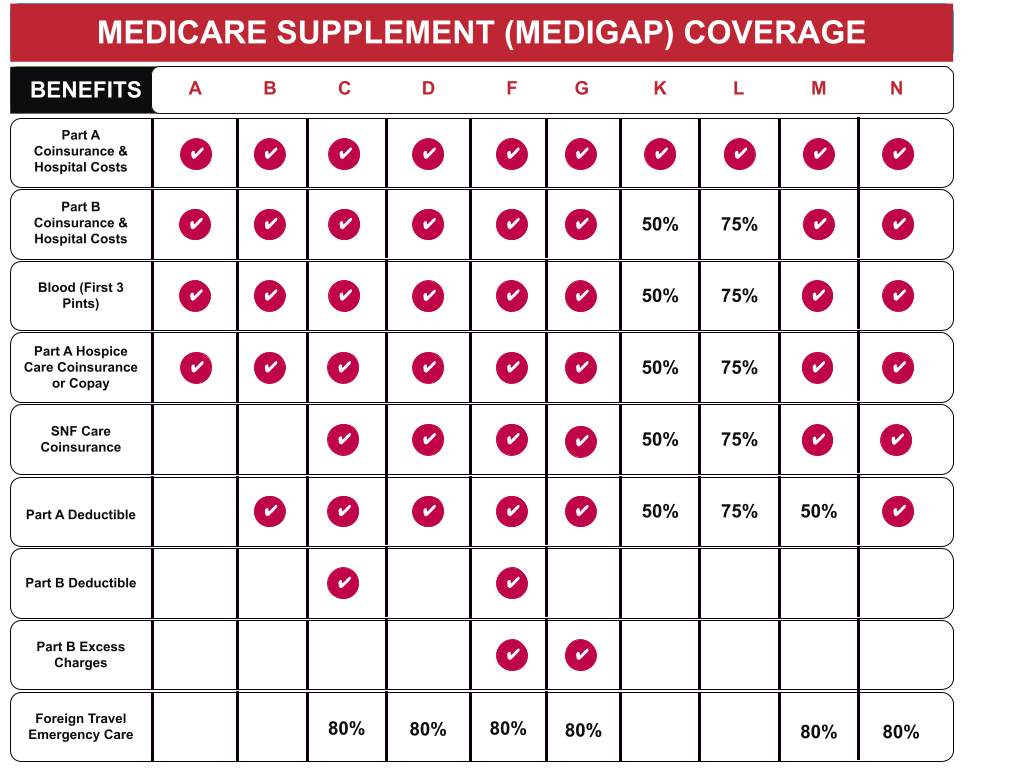

Medigap plans provide benefits that pay for certain Medicare-related costs. For example, if you have Plan F, almost all of your out-of-pocket costs would be paid by the Medigap plan. This means you would only need to pay your premiums, and other costs like Part A and B deductibles, coinsurance, and copayments are all covered by the Medigap plan. The only other thing you’d need to pay are the premiums for Part A and Part B.

Understanding Your Needs

If you rely on your Medicare benefits often, a Medigap plan could be incredibly helpful for lowering costs and making health care far more affordable. To understand your needs better, we suggest that you work with an insurance agent to compare the various Medigap plans. As there are ten plans, you should be careful when choosing. Picking the wrong one may result in you spending far more than is necessary.

Medigap Coverage For Everyone

If you are enrolled in Original Medicare, there is no reason not to get a Medigap plan. They make healthcare more affordable in most cases, so why wait to enroll? You can get started today by getting in touch with the Medicare Advisor of Louisiana LLC.