Medicare Advantage for Veterans

If you are a veteran, you likely get coverage from Veterans Affairs health insurance. So what should you do when you qualify for Medicare? Well, we suggest that you sign up and enroll in a plan. Through Medicare, you get additional coverage that will make health care services even more affordable.

Reach out to us today to book an appointment with one of our experienced agents!

What is Medicare?

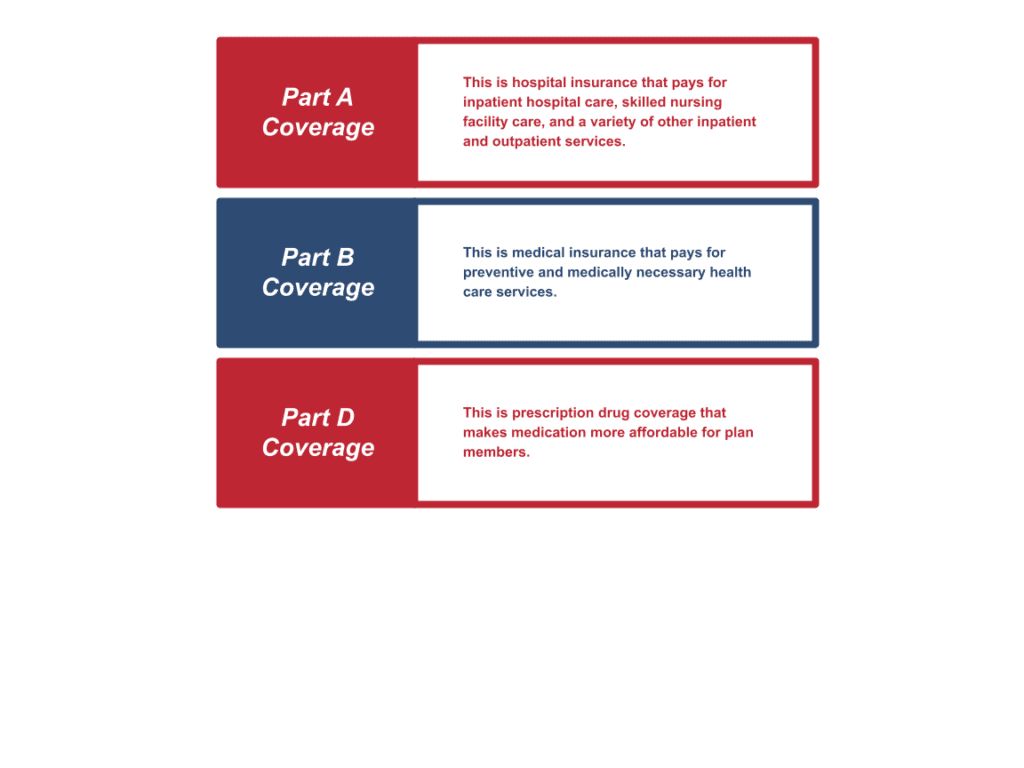

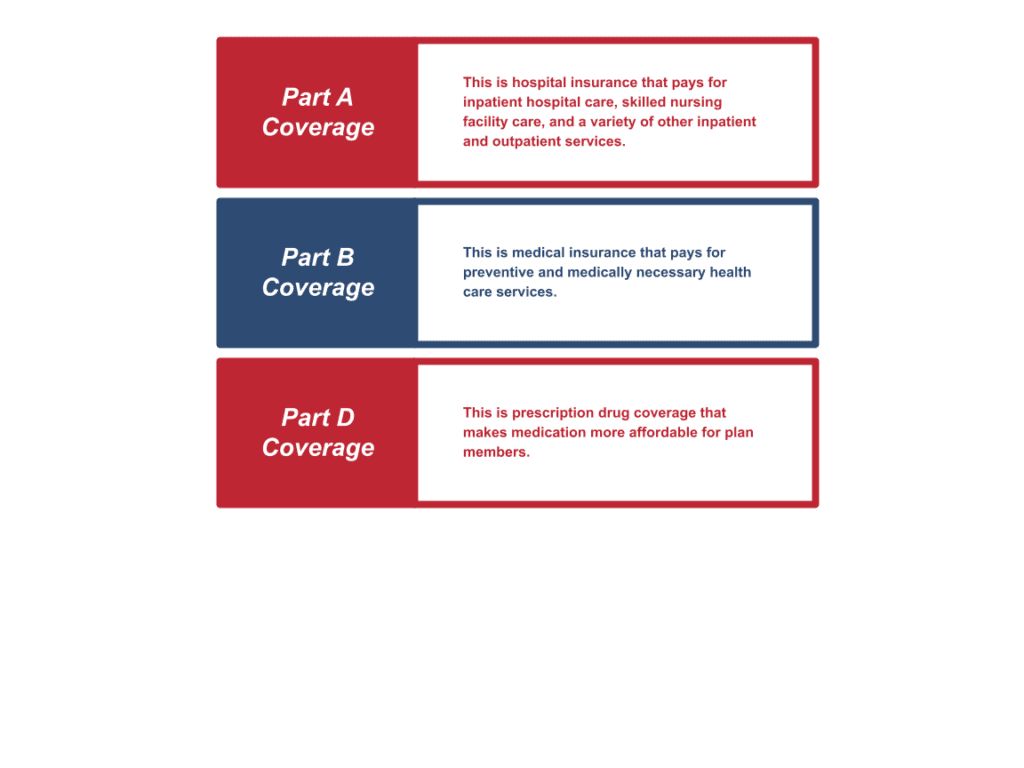

Medicare is a federal health insurance program that offers benefits to people age 65 and older, as well as people who suffer from qualifying disabilities. If you have Medicare, you are allowed to have other forms of insurance as well. Though, most major services are covered through Medicare. This is the coverage that you can get through Medicare:

You can also choose Part C, which allows you to get the above benefits through a private insurance company. Through Part C, you may also have access to additional benefits, such as dental and vision coverage.

Can You Have VA Benefits and Medicare?

Yes. If you have VA benefits, your Medicare coverage will be secondary to your VA benefits. This means that the VA plan will be the first payer on any account and Medicare will be the second payer. This only applies when you go to non-VA hospitals and doctors.

If you go to a non-VA doctor, your Medicare benefits will come in handy. Because the VA does not cover treatment outside of their facilities all of the time, having Medicare expands your options for who you can see for treatment.

Keep in mind that the VA may authorize treatment in a non-VA setting. In these cases, both Medicare and VA will provide payment for portions of the services rendered.

Combine Medicare and Veterans Benefits

When it comes to health insurance, more is better. To get as much coverage as possible, get Medicare in addition to your VA benefits. This will ensure that you can afford any treatment you need. With Medicare Advantage as an option, you can also open your options up to include many more health care providers.